- Howie Fenton

- |

- November 05, 2021

The last two years have been challenging, but it appears that the worst is over, and we are emerging in a new normal. Obviously, we must remain skeptical because it seems like the end was near before, but again, all indications are strong. This article will summarize the current state of the in-plant Industry and describe three long-lasting adverse effects that will persist and offer strategies to help you reduce the impact of those challenges.

It is impossible to separate the news of the pandemic from the business. This means much of the growing optimism results from vaccinations and the declining numbers of hospitalizations and deaths. This optimism is fueling growth in demand. Two of the most recent research reports citing this growth are NAPCO's "COVID-19 Print Business Indicators Research: Volume 2, Number 3" and the most recent survey from Big Picture magazine and Keypoint Intelligence.

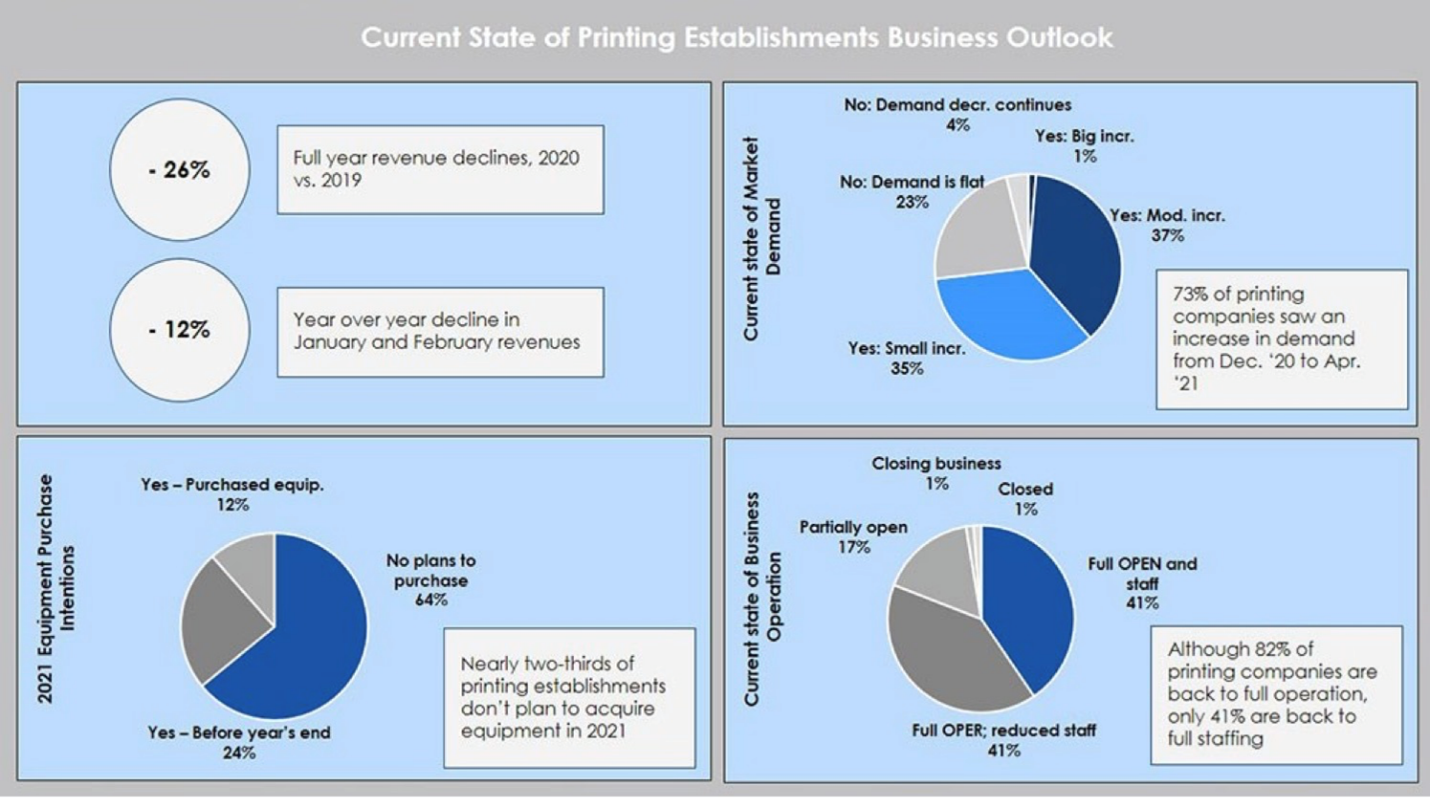

Keypoint says that business is increasing in several vertical markets such as hospitality and leisure, entertainment, and accommodation work in a recent blog. They also found 73% of companies saw an increase in demand from December 20, 2020 – April 21, 2021.

The NAPCO research found that sales surpassed year-earlier levels last quarter for 74.% of the companies they surveyed:

- Sales were up 10% or more for 64%,

- 20% or more for 47.3%, and

- 30% or more for 38%

- Leading business indicators rose to 78.3% last quarter from 61.8% three months ago and 42.9% one year earlier.

Bad News

The bad news is that staff are retiring, refusing to comply with vaccine mandates, and quitting, and supply issues reduce the availability of paper and toner shortages. Growth is not occurring for all. In addition, while some vertical markets maintain their work volume (healthcare and state in-plants), others are struggling, including Universities, manufacturing, retail, and hospitality.

This conclusion is consistent with the Keypoint Intelligence research in the table that shows that of the companies surveyed:

- 17% are only partially open

- 41% are fully operational but with reduced staffing

- 41% are fully open and fully staffed.

Future

Of all the good and bad news, three issues will take center stage for the foreseeable future: 1) slow return in demand for specific verticals, 2) paper availability, and 3) labor shortage. While there is no magic wand for any of these issues, there are some actions you can take to reduce the impact of the three issues.

In terms of staffing concerns, you might consider reading these articles we have written about this subject:

- Trends for In-Plants to Address in 2020

- Solutions for Resolving COVID-19 Staffing and Delivery Challenges that May be the New Normal

- How to Estimate Staffing Needs as Workload Changes

- Are You Prepared to Accelerate your Recovery?

If you are struggling with the slowly growing volume, you might consider some of these articles with a focus on strategies to motivate demand:

- 2019 Roadmap: Are you Thinking Outside the Box?

- Build a Better In-Plant – 3 Tips to Create a Better Marketing Plan

- Is it Time to Pivot to Growth Applications and Strategies?

- 7 Tips To Increase In-Plant Awareness, Generate Leads, and Sell More

There is an interesting article from Gartner about strategies to mitigate the impact of supply chain issues. It is entitled “Top Ideas for Weathering the Storm in a Supply-Constrained Market.” Here are four tactics from the article:

- Consolidate and negotiate volume directly with your supplier sub-tiers.

- Prebuys of supplier bill-of-materials components with longest lead times

- Future purchase commitments

- Consolidate across business units.

Summary

While the return to a new normal is certainly welcomed, it has also resulted in long-term challenges. Struggling with volume declines and staffing issues is not new, but trying to rehire to replace staff who may have retired, workplace restrictions requiring vaccinations and masks, and the trying to reacquire work that shifted to an electronic alternative is making this more difficult challenging. Here are three things to consider:

- First, consider thinking outside the traditional hiring box. Research what people want in a job today because it is changing. People are no longer just thinking that trading time for dollars. Succeeding in hiring in the future could depend on: how fun can you make their work environment, can they work different schedules (i.e. 4 - 10 hour days, 3 days off), are you willing to train completely untrained staff, are you willing to hire someone down on their luck, can you reward staff with time off, and are you being socially responsible.

- Second, consider out-of-the-box thinking about sales. In some articles we listed, we discuss building an on-call staffing strategy. This has significant benefits to both parties. It could show new people how you treat staff, how much you are willing to train them, how much your work benefits others, etc. This could not only help you address peaks in demand but also serve as a training and evaluation tool for full-time positions.

- Lastly, as we see with the airlines, too much attention to Just In Time and Lean manufacturing resulted in fragile systems and susceptibility to breaking after staff and materials decline. Unfortunately, there is no magic wand. If you are struggling with ink, toner, and paper shortages, you might need to create an ongoing search strategy for new suppliers. In addition, you may also have to master a testing procedure to ensure that you can quickly identify quality problems when you try to use these new supplies and build workaround solutions.