- Elisha Kasinskas

- |

- August 19, 2019

Know the customer.

That may seem like an obvious statement, but don't underestimate the importance of fully understanding the in-plant customer whether you are out to meet their hardware or software needs. The 2019 "North American Production Software Investment Outlook" from KeyPoint Intelligence|InfoTrends provides intriguing insights into who these customers are, how much they are currently spending per year on software, and their biggest workflow issues.

Although only 30 of the 122 respondents work in in-plants (the other 92 were commercial printers), and the survey doesn't differentiate between the two in some of the findings, most respondents can be categorized as high-level decision makers. Positions denoted in the survey that can be considered key positions inside the in-plant include General Manager/Managing Director (21%); Prepress, Production Manager, or Supervisor (21%); COO, VP Manufacturing or CTO (7%); and IT Manager or CIO (3%). If you're selling a workflow solution, those are the people you need to know if you don't already.

The In-Plant Landscape

What about the in-plant itself? According to the KeyPoint Intelligence | InfoTrends Study, the average in-plant has 26 employees. Nearly three quarters of the in-plants surveyed have 1-4 (24%), 5-9 (24%), or 20-49 (24%) dedicated employees. Another 21% of respondents have 10-19 employees. Even if a software reseller only focuses on the 48% of in-plants who have between 1-9 employees, that's a sizable population of organizations that could potentially benefit from automation. And as the survey points out, there's plenty of tasks that have yet to be automated in many of these organizations.

Most In-Plants See the Need

Some in-plants understand the need to automate and are taking steps in that direction. It's interesting to see where these organizations have implemented workflow automation where most jobs require no operator intervention.

Online order to job creation is the most likely task to be automated (57%), followed by imposition (30%), job tracking (30%), file conversation/optimization (27%), and shipping delivery/preparation (20%), according to the survey. But looking at those percentages, there's plenty of room to increase the levels of automation.

Only 3% of in-plants responding to the survey said their workflows were fully automated while 30% have not automated any of their workflows. That's a significant number and for anyone selling workflow automation software such as Rochester Software Associate's (RSA's) QDirect or a Web to print solution such as WebCRD, an opportunity to improve workflow and job submission within those in-plants. Beyond that 30%, there are opportunities for in-plants to expand their workflow automation by automating other tasks that are still handled manually.

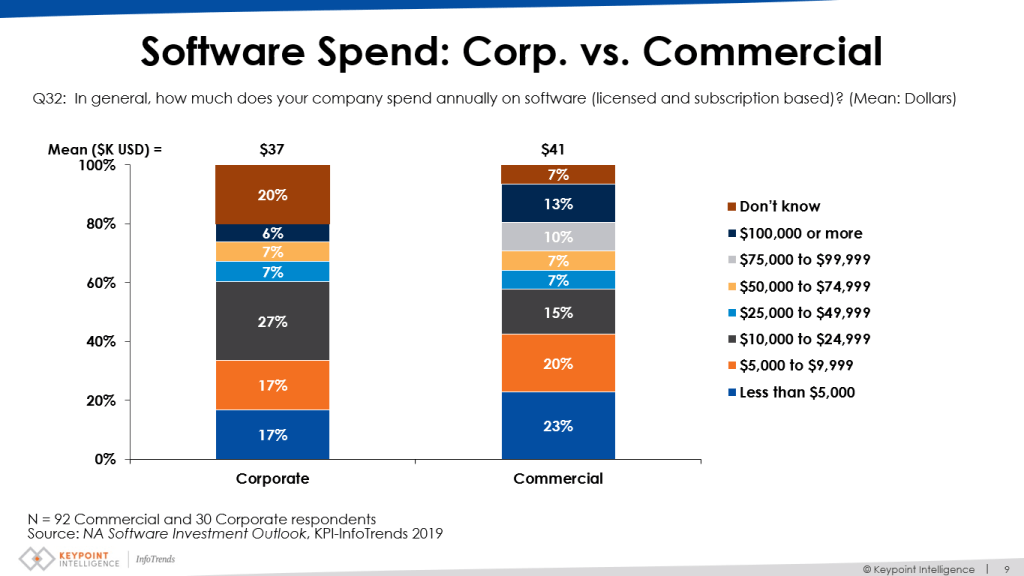

Cost Conscious In-plants that responded to the survey are spending money, on average $37,000 a year on software. For the record, that's not much different than the $41,000 the survey reports commercial printers spend on software a year.

The more significant finding is that 34% of in-plants spend less than $10,000 a year on software. This offers further validation that most in-plants have yet to see the value in automating critical workflows throughout the printing process.

The challenge is convincing in-plants to disrupt the status quo. But what's wrong with the status quo?

Nothing if it doesn't negatively impact one's business or bottom line. But failing to invest is leaving key tasks that can be better handled through automation, mired in a manual rut.

In our previous blog we reported on some of the biggest bottlenecks in an in-plant's current workflow per the KeyPoint Intelligence|InfoTrends study. To recap, dealing with a high number of small jobs (50%), increasing throughput and shortening production times (33%), and customizing the workflow to the in-plant's needs (30%) ranked as the top three bottlenecks. But let’s not ignore the next two—complexity of software (20%) and working with legacy or old software systems (20%)—two more indicators that for many in-plants, there must be a better way.

If you are selling workflow automation software, you likely have in-plant customers who have benefited from automation and who you can cite as examples to in-plant customers and prospects hesitant to invest in software. Discuss the steps these customers took to automate, how their staff was trained on the software, and most of all, outline the ROI these in-plants experienced after automation. Those customers stuck in a manual rut need you to show them the way.

For those who protest and say this is the way we've always done it, it may be tough, but continue to educate them about the software's benefits, emphasizing that the old way is no longer the best way. Although an in-plant doesn't typically have the same competitive pressures as a commercial printer where automation is often a matter of survival, your approach should be to open minds no matter how closed they are about investing in workflow automation tools.

Next Steps

It's all about productivity, it's all about reducing costs, and it's all about completing jobs on time. The solution, and one that warrants repeating, in terms of these many benefits, is automation. The tools are available, the challenge is convincing decision makers that the time is now to automate. Of course, that's easier said than done. But why not take it one win at a time, and build on each of those individual wins? Sometimes all it takes is one champion in an organization to see the light and convince other decision makers. Who knows, those tough customers may finally come to realize, that to save money in the long term, they need to spend some in the short term.

Contact your local RSA Business Development Manager to learn how you can successfully help an in-plant automate with a workflow solution such as QDirect or a Web to print solution such as WebCRD.