- Elisha Kasinskas

- |

- July 22, 2020

The 2020 North America Production Software Investment Outlook from Keypoint Intelligence reveals that in-plants and commercial printers are bullish about business, including software implementation over the next two years. However, that bullishness reflects responses from the first quarter of 2020 when the survey was conducted prior to the pandemic’s impact on those businesses.

The study depicts significant growth in various segments related to in-plants over the next two years, which during pre-COVID-19 times would have inspired optimism for resellers of production print hardware and software. Consider the following findings:

- Print Volume Produced in an Automated Workflow – 100% growth from 2020-2022

- Print Volume Produced Via W2P – 23% growth from 2020-2022

- Print Volume Produced Using CYMK+ Printing – 37% growth from 2020-2022

Although this growth can partially be attributed to new software sales, growth, particularly with Web to print and color volume reflect ongoing trends.

Still, in today's environment, these projected growth percentages are a best-case scenario if they hold during the pandemic. It might also be considered good news for resellers of production print software such as RSA's Web to Print solution WebCRD or our output management solution QDirect.

However, current indicators—what in-plants, commercial printers, and resellers have experienced during the past four months and what they expect to continue to experience—reveals an alternate reality that contrasts with some of the study's results.

What Production Solutions Dealers are Saying

Scott Cullen, editor-in-chief of The Cannata report has a direct line to many resellers of production hardware and software. Many have told him that they do not expect to sell large amounts of either in the short term. However, Cullen said that there are still a few who remain cautiously optimistic as businesses reopen and employees return to work.

"Even if the aggressive growth suggested by the study does not occur as predicted over the next two years, you still may see interest in production print software inside and outside of the in-plant," said Cullen. "It all depends on who you talk to and the market segments they serve."

As one reseller shared with Cullen during a recent interview, "Volumes are going up. We even referred a number of customers to our commercial clients for customized printing applications. On the educational side, we expect to see more printing going on there as well."

A reseller with a significant wide-format business has found the need for signage and directional information related to social distancing has created new opportunities.

The pandemic inspired a Florida-based reseller to expand his hardware and software portfolio to keep pace with evolving customer needs around UV and wide-format products. And in this era of social distancing, he sees a big opportunity for selling Web to print software.

"I've also heard contrasting degrees of optimism within the same reseller organization," observed Cullen. "For example, in one large dealership, the individual managing the production print business expects business to eventually returning to pre-pandemic levels while one of the company's owners is more pessimistic, particularly around high-end production equipment sales. His reasoning is that customers aren't willing to make three to five-year commitments to those devices unless they have print clients who are willing to make three to five-year commitments to them. On the other hand, he sees an opportunity in corporate in-plants as businesses look to control of their printing costs and do more variable data printing in house."

This dealer views corporate in-plants as a sweet spot for production, while print for pay, which is dependent on other customers, will struggle.

In-Plant Business Strategies = Software Sales Opportunities

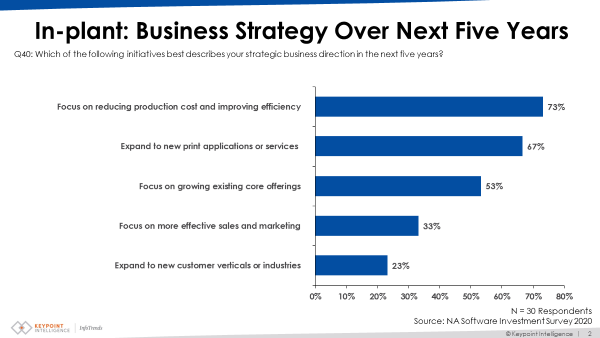

One thing that has not changed during the pandemic and the uncertainty around print is the value add that workflow and Web to print software provides. The study identifies the top business strategies in-plants and commercial printers will have over the next five years. These strategies underscore the need for software that supports those strategies by automating manual processes and collecting and managing data even if customers are not yet ready to make an investment today.

- Focus on reducing production cost and improving efficiency – 73%

- Expand to new print applications or services – 67%

- Focus on growing existing core offerings – 53%

- Focus on more effective sales and marketing – 33%

- Expand to new customer verticals or industries – 23%

A Compelling Story

As commercial printers and in-plants reopen and start processing print jobs again, some with fewer staff, others at pre-COVID-19 levels, software that facilitates these processes has the potential to resonate even more going forward than before the pandemic. Although it is unlikely growth will be what it has in the past, resellers of production software still have a compelling story to share with customers and prospects.

Poise Your Dealership for Growth with Production Print Workflow Software

Learn how you can bolster your production print offerings with digital workflow software solutions such as QDirect output manager, WebCRD Web to Print or ReadyPrint universal prepress.