- Howie Fenton

- |

- September 04, 2025

Sweeping tariffs have broadened import duties on foreign goods, including critical materials used in printing, such as paper, toner, and printing equipment. These policies are having an acute impact on in-plant printers, who often operate on tighter budgets and thinner margins than commercial print shops. This is the first article in a two-article series that focuses on a strategy to maintain service levels and financial sustainability. In this blog, we discuss how in-plant operations must implement targeted pricing strategies, agile sourcing plans, and forward-looking mitigation tactics, while also preparing for vastly different potential outcomes depending on how the broader print industry adapts to this new economic climate. The second article will discuss the best and worst-case scenarios.

Pricing Options

As tariffs continue to raise the cost of materials and consumables critical to printing operations, in-plant printers face growing financial pressure. Unlike commercial print shops that can directly adjust their pricing to reflect increased costs, in-plants operate within internal budget frameworks and must find alternative strategies to manage these economic challenges. This calls for a more strategic approach to pricing, cost control, and resource allocation. In-plant leaders must carefully evaluate how to manage rising costs without diminishing service quality, and determine which tactics — whether absorbing costs, improving operational efficiency, or reprioritizing high-value services — will best protect their value to the organization.

Absorbing vs. Passing Costs:

Unlike commercial print shops, in-plants typically don't charge internal customers directly, meaning they can't easily pass costs downstream. However, internal pricing models (chargebacks) or cost-center reports are increasingly being used to justify budget increases or drive efficiency mandates. For state or higher education schools who can only increase prices once or twice a year you need to implement increases as soon as possible. Typically you will have to collect and present clear data showing the financial impact of tariffs and the value they provide relative to outsourcing.

Leveraging Managed Print Services (MPS) and Workflow Automation:

Through MPS and workflow automation, in-plants can cut print volumes, optimize equipment utilization, reduce consumable waste, and automate time-consuming processes. These technologies become critical tools for offsetting cost increases without compromising service delivery.

Prioritizing High-Margin or Mission-Critical Work:

By analyzing job cost data and service value, in-plants can identify high-return applications — such as secure printing, direct mail, or regulated documentation — that justify continued investment and protect their strategic role in the organization.

Alternative Sourcing Strategies

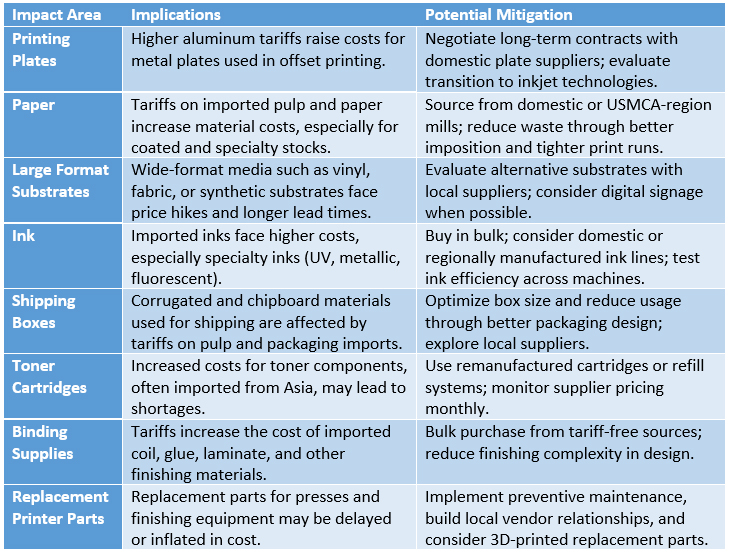

As escalating tariffs continue to disrupt traditional international trade routes and drive up the cost of imported materials such as paper, ink, and replacement parts, in-plant printers are under growing pressure to rethink and restructure their sourcing strategies. Long reliant on overseas suppliers — particularly in Asia and Europe — for competitively priced goods, many in-plants are now grappling with unpredictable delivery times, sudden price hikes, and overall supply chain fragility. These challenges are particularly acute for operations supporting time-sensitive internal campaigns, where delays or shortages can ripple across departments and undermine organizational performance.

In response to rising tariffs and ongoing supply chain instability, forward-looking in-plant leaders are exploring alternative sourcing strategies that emphasize stability, cost control, and long-term resilience. A major shift is the move toward reshoring or nearshoring critical supplies — such as paper, ink, and replacement parts — to vendors based in North America. While these sources may not always offer the lowest prices, they provide tariff-free access, more predictable delivery timelines, and reduced geopolitical risk, which is especially critical for time-sensitive operations. At the same time, supplier diversification is becoming a key strategy: by building broader networks of vendors across regions and materials, in-plants reduce dependency on any single source, strengthen negotiating leverage, and protect against sudden disruptions or cost spikes.

In addition to shifting geographic sourcing and broadening supplier pools, in-plants are also exploring innovative, local material alternatives. By working with domestic vendors that offer recycled, remanufactured, or sustainably produced goods, in-plants can offset some of the cost pressures associated with tariffs while aligning with their organization's environmental and corporate responsibility goals. These locally sourced options often have shorter supply chains and fewer import-related complications, providing added stability in uncertain times. Together, these sourcing strategies not only help in-plants manage the financial impact of tariffs but also build long-term resilience and operational flexibility.

Mitigation Strategies

To navigate the ongoing challenges posed by tariffs, in-plant printers must adopt a range of mitigation strategies that go beyond immediate cost-cutting. One such approach is rethinking inventory management. While stockpiling materials in advance of known tariff increases can provide short-term relief from price shocks, this strategy carries significant drawbacks, such as increased warehousing costs, risks of material obsolescence, and inflexible capital tied up in unused supplies. A more effective and sustainable alternative is to implement agile inventory models that rely on historical usage data, demand forecasting, and predictive ordering. This allows in-plants to maintain optimal stock levels, respond quickly to market changes, and avoid both overbuying and supply shortages.

In addition to internal operational strategies, external engagement through policy advocacy can be a powerful tool. By actively participating in trade associations such as PRINTING United Alliance, the National Association of Manufacturers (NAM), and the In-Plant Printing and Mailing Association (IPMA), in-plant leaders can contribute to shaping federal trade policy, request exemptions or relief measures, and stay informed about upcoming regulatory developments. These organizations often serve as the collective voice of the industry, providing access to key decision-makers and amplifying concerns specific to the printing sector, significant for in-plants that lack individual lobbying power.

Another important mitigation strategy is digital substitution. As materials like paper and toner become more expensive due to tariffs, transitioning certain communications and workflows to digital formats can yield significant savings. By adopting e-signature solutions, cloud-based document management systems, and secure digital communications, in-plants can reduce their dependency on physical materials and improve operational efficiency. These digital tools also enhance speed, security, and auditability, aligning with broader organizational goals around modernization and sustainability. Together, these mitigation strategies help in-plants not only weather the current tariff landscape but also position themselves as forward-thinking, resilient components of their organizations.

How RSA Can Help

Rochester Software Associates (RSA) offers a suite of workflow automation tools that help in-plant printers minimize waste, increase efficiency, and reduce dependence on costly materials:

- WebCRD® Web-to-Print Software streamlines order intake and eliminates manual touchpoints, reducing costly reprints due to errors or miscommunications.

- QDirect® Output Manager consolidates and intelligently routes jobs based on priority, media type, or device capability—optimizing usage of paper, ink, and machine time.

- ReadyPrint™ Prepress Automation automatically performs preflight checks, file corrections, and job ticketing to reduce labor and speed up production, which is critical when labor or replacement parts are delayed due to tariffs.

By integrating these RSA tools, in-plants can gain data-driven insights, automate labor-intensive tasks, and optimize resource usage, translating into direct cost savings that offset tariff-related increases.

Summary

The 2025 tariff surge has reshaped the landscape for in-plant printers, driving up the cost of essential materials and complicating long-established sourcing pipelines. Unlike commercial shops, in-plants can't simply raise prices—they must rethink internal chargebacks, resource prioritization, and workflow efficiency to stay viable. Pricing responses include absorbing costs strategically, embracing managed print services (MPS), and focusing on high-impact jobs that justify continued investment.

On the sourcing front, many in-plants are shifting toward North American suppliers and expanding their vendor networks to avoid the unpredictability of global supply chains. Reshoring, supplier diversification, and exploring recycled or remanufactured materials are all proving to be powerful tools in building long-term resilience.

Robust mitigation strategies are essential. Agile inventory models, preventive maintenance, participation in industry associations, and digital substitution tactics are helping in-plants reduce exposure and modernize operations. Tools from Rochester Software Associates (RSA)—such as WebCRD, QDirect, and ReadyPrint—offer automation and workflow efficiencies that directly reduce waste, labor costs, and reprint errors, delivering real ROI in a tariff-challenged economy.

Together, these pricing, sourcing, and mitigation strategies form a robust roadmap for in-plant printers to protect their role, reduce costs, and demonstrate lasting value to their parent organizations amid a volatile global trade environment.