- Howie Fenton

- |

- July 26, 2017

If you are a regular reader, you may already know that we working with industry consultant, Howie Fenton, to create information for dealers, reps and owners and print equipment vendors to help them better understand the in-plant market. Comprised of two six-article series (for a total of 12 articles), each compiled into an eBook and an overall topic webinar to be held on 8/23/17, the initiative is called "In-Plant Primer: From Operations Basics to Advanced Sales Concepts." This is the first post of the advanced in-plant primer series, "In-Plant Primer 201: Operational and Financial Concerns." In this portion of the primer series, we will cover more advanced topics, including: in-plant financial models, vertical markets, terms to use—and avoid, management and administration views of in-plants, measuring in-plant operational performance and how software automation increases the value of the in-plant.

Key Take Aways

- In-plants operate on at least four business or financial models.

- The different models impact how they are evaluated and if they know their costs.

- Understanding the model can also help you realize how much they value reducing costs and their vulnerability to outside threats.

In-plant Financial models and How They Impact Decision Making, Purchases and the RFP Process

In this blog, we will talk about four different business models or financial models used by in-plants or corporate and in-house print centers as they are sometimes called. Understanding the financial model that an in-plant uses is important in the sales process as it impacts their motivation to seek out solutions and the benefits you should highlight in your conversations with the customer. The knowledge you gain from understanding the issues a financial model can cause will help you better drive the sales conversation to a successful conclusion. For more about sales questions, see our post, "8 Probing Questions to Sell Workflow Solutions." The different models are one of many factors that can determine the in-plant's pricing and make them more or less vulnerable to external threats. For example, if the in-plant's business model is to charge back customers and make a profit, pricing is higher than in-plants designed to break even financially or are partially funded. Most in-plants are designed to provide a service for their customers and not make money. Many in-plants don't pay for space or utilities and don't charge taxes or add margins for profits which helps them remain cost competitive. The small percentage that are designed to make a profit are therefore less price competitive. Different in-plants use different financial models to pay for the cost of running the in-plant. Some charge their customers for every order (charge back) and are designed to fully recover all costs. Others cannot fully recover the costs and must be partially funded. A growing trend is to make a profit, while others are fully funded by the parent organization.

Four In-plant Financial Models

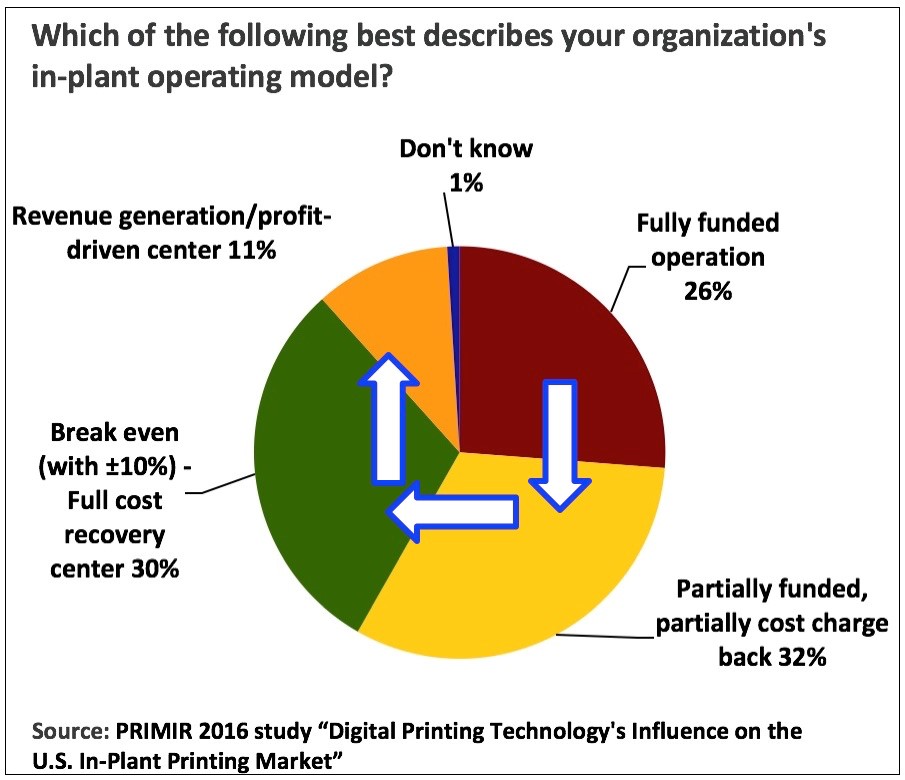

In the research that we conducted with IDC for the 2016 Primer Study 2016 Digital Printing Technologies Influence on the US In-Plant Market, we found about 26% of in-plants were fully funded, 33% partially funded, about 30% were full cost recovery/breakeven (±10%), and about 10% were revenue or profit driven.

- Fully funded by parent organization (~ ¼ of in-plants) - In a fully funded model, the in-plant and the parent organization typically work together to develop a budget that is used to operate the in-plant. The in-plant operation often is considered a necessary means of doing business. Many produce key business transaction applications, such as statements, bills, and invoices.

- Partially funded, partially charge-back customers (about 1/3 of in-plants) - In this model, the in-plant receives funds from the parent organization, but the operation also relies on revenue generated from charge-backs to keep afloat. Close to one-third of the in-plants surveyed operate under this model.

- Full cost recovery/breakeven (±10%) - charge-back to customers (about 1/3 of in-plants) - Within this model, the in-plant is self-supporting. Performance and relevance often are evaluated based on the in-plant's ability to meet its financial obligations and customer feedback.

- Revenue/profit center (about 10% of in-plants) - Revenue/profit-generating in-plants are designed to not only self-sustain but also to contribute business growth to the parent organization. Performance often is evaluated based on the ability of the in-plant to meet and exceed its financial obligation and service level agreements.

In-plants that charge-back are designed to breakeven or lose a small amount of money (-10% annual sales) and may be evaluated on price. In-plants designed to generate revenue (+15% annual sales) are evaluated on their ability to make money.

Summary

The financial model used impacts prices and determines the in-plant's susceptibility to external threats. Those that generate revenue are the least susceptible to threats because the parent company is happy with the revenue. In-plants that are fully funded (about 26% of all in-plants) don't charge back for each job. While departments are charged yearly or quarterly, the cost per piece may be unknown which leaves them vulnerable to external threats whose business proposition is that they make it for less. In contrast, 62% of in-plants do charge back customers for each job (partially funded or designed to break even). Those that charge per job are susceptible to complaints from customers about high prices. Customers may complain that they can buy it for less. While not always accurate, these complaints can open the door to threats from the outside. The point is that both fully funded and charge back in-plants are interested in cutting costs but for slightly different reasons. The take home story is that understanding the in-plant's business/ financial model will help a dealer or vendor in the sales process understand the prospect's motivation to seek out solutions and the benefits you should highlight in your conversations with the customer. Some financial models result in issues that make reducing costs most important, while others may make an in-plant feel more vulnerable to outside threats and create a desire to invest in hardware and workflow software solutions to make them more competitive. Understanding these differences will help you better position you and your solutions. In our next 201 primer article we will talk about the different in-plant vertical markets, sizes and concerns.

Learn More About In-plants in Your RSA Partner Portal

Access your partner portal for in-plant resources, eBooks from this series, a recorded webinar and more.