- Howie Fenton

- |

- September 19, 2017

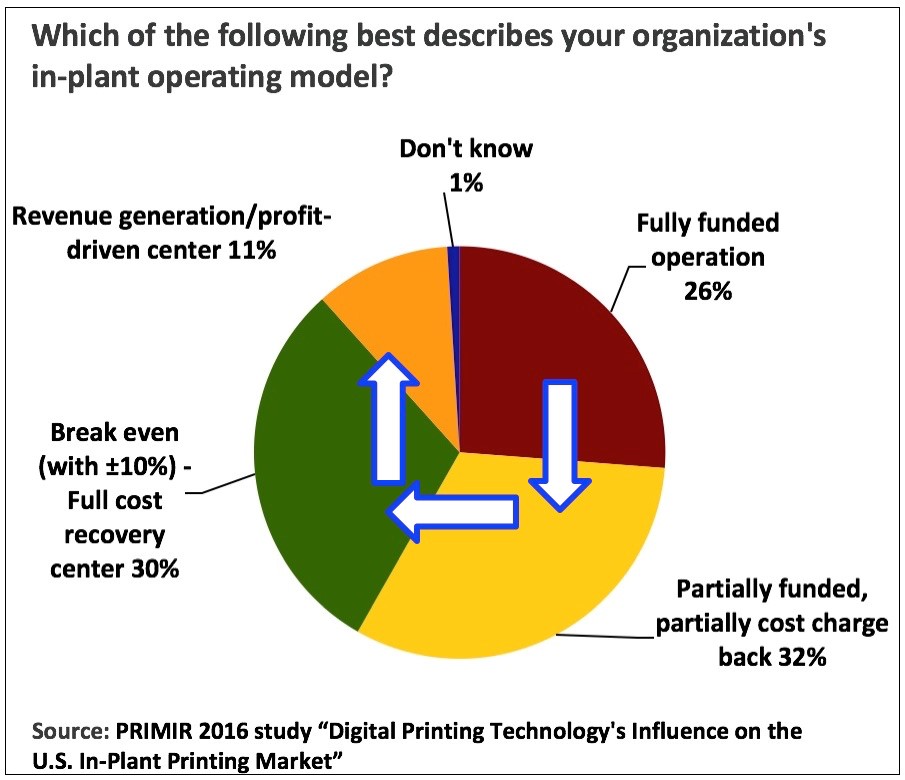

In our last In-plant Insights blog post we talked about the different in-plant business models: fully funded, partially funded and partially charge-back, full cost recovery / break-even and revenue or profit-driven. During a recent webinar, we offered an observation about the changing business models which is represented by the blue arrows in the graphic. Although only observation, we believe that:

- Some of the fully funded in-plants are shifting to the partially funded model,

- Some of the partially funded in-plants are moving toward the break-even financial model and

- Some of the break even in-plants are moving toward the revenue generation model.

The question is, if this is true what could this mean?

Greater Financial Transparency

We believe that this shift in in-plant operating business models is due to a change in attitude or philosophy of companies that have been long term users of internal print or mail services and have become frustrated with their inability to prove the value of the in-plant's performance. Historically, when in-plants are created they are created with a vision. This vision could be: to provide an easily accessible, convenient service for staff; reduce the time or costs of outsourcing; better monitor the use of their logo and brand identity; reduce the risk of a security breach; and various combinations of these objectives.

Over time however, the department that the in-plant reports to can change, the manager in administration can change, and management in higher levels of the enterprise can change. Any of these changes can prompt reviews of the in-plant's performance. The challenge is that several of these models don't charge back for individual jobs, which makes cost justification in general and pricing comparisons of internal cost/product vs. outside price/product challenging.

For example, most fully funded and some partially funded in-plants calculate the total cost of operation and simply divide that up and charge the departments that use them most. In contrast, break-even and revenue generating in-plants must calculate the price/product because they are charging for each job.

If there is a shift in the business model we believe that it is from companies that are long term in-plant users who have gone through changes and are looking for an operating model that includes metrics that can more easily cost justify the in-plant, better compare prices and/or generate revenue for the parent company.

What are your thoughts? Have you shifted the operating model that your in-plant uses, and if so, why?